The global oil market is once again under pressure, with crude prices surging to their highest levels in five months. As of this week, Brent crude has climbed above $90 per barrel, while West Texas Intermediate (WTI) has also seen a sharp uptick, touching over $86 per barrel. The latest spike in oil prices is largely attributed to escalating geopolitical tensions in the Middle East, ongoing supply constraints, and renewed concerns about energy security.

In this article, we explore the key reasons behind the current oil price rally, its global economic implications, and what investors and consumers can expect in the months ahead.

1. Middle East Tensions Spark Market Fears

The Middle East remains one of the world’s most critical oil-producing regions. Any instability in this area has historically sent ripples through global markets. The latest concerns stem from escalating military tensions between Israel and Hezbollah, as well as continued uncertainty surrounding Iran’s role in regional conflicts.

Recent drone strikes, cross-border exchanges, and threats of broader conflict have reignited fears of supply disruptions. The Strait of Hormuz—a key maritime chokepoint where nearly 20% of global oil passes—has once again come into the spotlight. Investors worry that if conflict spreads, it could severely impact oil transportation, leading to shortages and further price hikes.

2. OPEC+ Maintains Output Cuts

Another major factor pushing oil prices higher is the continued output restraint by OPEC+—a group of major oil-producing countries led by Saudi Arabia and Russia. Despite growing global demand, the group has opted to extend production cuts through the third quarter of the year.

Saudi Arabia, in particular, has reaffirmed its voluntary 1 million barrel-per-day cut, contributing to a tighter global supply environment. Russia has also indicated it will continue export curbs, adding to the supply crunch.

These strategic moves are designed to support market stability and protect oil-exporting economies, but they come at a cost: higher energy prices for consuming nations.

3. Strong Demand From Asia and the U.S.

While geopolitical risks are triggering speculative buying, fundamental demand for oil remains robust—especially in Asia. China, the world’s largest oil importer, has seen a recent rebound in industrial activity and travel demand. India is also experiencing a summer demand surge, with increased consumption in transportation and power generation.

In the United States, the summer driving season has started strong, with gasoline demand trending higher week over week. The U.S. Energy Information Administration (EIA) reported a substantial draw in crude and gasoline inventories, signaling stronger consumption than expected.

These demand-side dynamics are amplifying the effects of supply-side restrictions, creating the perfect storm for oil bulls.

4. Energy Markets and Inflation Worries

Rising oil prices have significant implications beyond the energy sector. For many economies—especially those already battling inflation—higher crude prices can stoke broader price pressures. Transportation, manufacturing, and agriculture all rely heavily on oil. As costs rise, these increases are passed on to consumers.

In the U.S., the Federal Reserve has kept interest rates elevated in a bid to control inflation. However, surging oil prices may complicate the Fed’s efforts, potentially delaying rate cuts or prompting further policy tightening.

In Europe, central banks are similarly watching energy markets closely, fearing that persistent oil inflation could derail their progress on economic recovery.

5. Impact on Global Markets

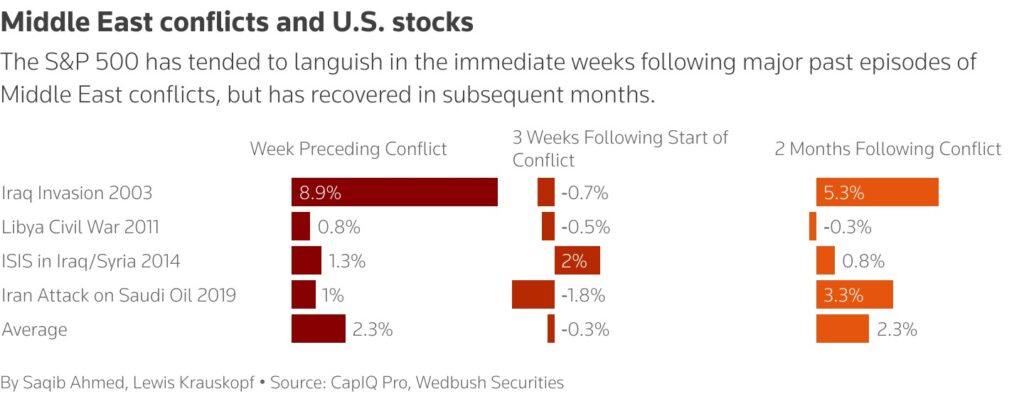

Stock markets have responded cautiously to rising oil prices. While energy stocks have benefitted from increased investor interest, airlines, shipping companies, and manufacturing firms are bracing for higher operating costs.

Emerging markets, which are often more vulnerable to commodity price fluctuations, may face increased pressure on their currencies and trade balances. Nations that import most of their oil—like Turkey, Pakistan, and Bangladesh—are already dealing with higher import bills and weakening currencies, which could strain their economic outlook further.

6. Strategic Petroleum Reserves and Government Response

In response to the latest surge in oil prices, some governments are considering releasing strategic petroleum reserves (SPR) to stabilize markets. The U.S. Department of Energy has signaled that it is monitoring the situation but has not yet committed to another SPR release.

Meanwhile, countries like India and Japan are also evaluating ways to manage domestic fuel prices, including subsidies and potential inventory releases to buffer against inflationary pressure.

Governments across the globe are also urging OPEC+ to consider production adjustments that align better with current global demand and economic recovery needs.

7. Currency Effects and the U.S. Dollar

Oil is typically traded in U.S. dollars, so fluctuations in currency markets can also influence crude prices. A weaker U.S. dollar often makes oil cheaper for international buyers, boosting demand. Conversely, a strong dollar tends to exert downward pressure on prices.

With mixed economic signals and ongoing interest rate uncertainty, currency markets remain volatile. Any substantial move in the dollar—especially in response to Federal Reserve actions—could either amplify or mitigate oil price changes in the coming months.

8. What to Expect Going Forward

With a combination of geopolitical risk, coordinated output cuts, and strong demand, oil prices are likely to remain elevated in the short term. Analysts suggest that if current tensions in the Middle East escalate further, Brent crude could test the $100 per barrel mark—a level not seen since the energy shock of early 2022.

However, much will depend on diplomatic developments, particularly regarding Iran-Israel tensions and OPEC+ policy decisions in the next few months. If diplomacy prevails and supply chains remain intact, some price moderation could occur.

For now, both consumers and businesses must prepare for a period of energy price volatility, with downstream effects on inflation, spending habits, and market sentiment.

Conclusion

The surge in oil prices to a five-month high reflects a complex interplay of Middle East tensions, strategic output cuts, and resilient global demand. With Brent crude nearing $90 per barrel and concerns mounting over potential supply disruptions, the global economy may face renewed inflationary challenges and energy security concerns.

Governments, investors, and businesses are closely watching how the situation unfolds. While long-term strategies may involve renewable energy and diversification, the immediate future will likely remain shaped by oil market dynamics and geopolitical headlines.

For consumers, this could mean higher prices at the pump, increased transportation costs, and a general uptick in living expenses—another reminder of just how intertwined energy and global stability truly are.